Welcome to our guide on creating and managing a home budget! Whether you’re a seasoned budgeting pro or just starting, this article will provide you with the necessary tools and information to take control of your finances. We’ll cover everything from the basics of budgeting to advanced strategies for maximizing savings and minimizing expenses. Let’s dive in!

What is a Home Budget?

A home budget is a financial plan that outlines your income and expenses, allowing you to track your spending and make informed decisions about how to allocate your money. It serves as a roadmap for your financial goals, helping you prioritize and manage your finances effectively. A well-planned budget can provide you with financial security, reduce stress, and help you achieve your long-term goals.

Why Should You Create a Home Budget?

Creating a home budget brings numerous benefits and is an essential step in achieving financial stability. Here are some of the key reasons why you should create a budget:

1. Financial Awareness: A budget helps you gain a clear understanding of your income, expenses, and overall financial situation.

2. Control Over Spending: With a budget, you can prioritize your spending and avoid unnecessary expenses.

3. Debt Management: A budget allows you to allocate funds towards paying off debts and avoiding debt accumulation.

4. Savings and Investments: By budgeting, you can set aside money for savings and investments to achieve your financial goals.

5. Emergency Preparedness: A budget helps you build an emergency fund to cover unexpected expenses.

6. Goal Achievement: A budget enables you to save and invest towards specific goals such as buying a home, starting a business, or retiring early.

How to Create a Home Budget

Now that you understand the importance of a home budget, let’s dive into the step-by-step process of creating one:

1. Determine Your Income

The first step in creating a budget is determining your income. This includes your salary, wages, bonuses, and any other sources of income. If your income varies from month to month, calculate an average to work with.

2. Track Your Expenses

To create an accurate budget, you need to track your expenses. Start by recording all your expenses for a month, including fixed expenses like rent or mortgage payments, utilities, insurance, and loan repayments. Also, track variable expenses like groceries, dining out, entertainment, and transportation.

3. Categorize Your Expenses

Once you have a month’s worth of expenses, categorize them into groups such as housing, utilities, transportation, groceries, entertainment, and savings. This will give you a clear picture of where your money is going.

4. Set Financial Goals

Now that you have a clear understanding of your income and expenses, it’s time to set financial goals. These goals can be short-term (paying off debt), mid-term (saving for a vacation), or long-term (retirement planning). Make sure your goals are specific, measurable, achievable, relevant, and time-bound (SMART).

5. Allocate Your Income

Based on your income and expenses, allocate your money towards different categories. Start with essentials like housing, utilities, and groceries, then allocate funds towards debt repayment, savings, and investments. Be realistic and prioritize your goals.

6. Track and Adjust

Once you have a budget in place, it’s important to track your spending regularly. Use budgeting apps or spreadsheets to monitor your expenses and compare them to your budget. Make adjustments as needed to stay on track and achieve your financial goals.

7. Review and Reflect

Periodically review your budget and reflect on your progress. Celebrate your achievements and identify areas for improvement. A budget is a dynamic tool that can be adjusted as your circumstances change.

8. Seek Professional Help if Needed

If you’re struggling to create or manage your budget, don’t hesitate to seek professional help. Financial advisors or budgeting experts can provide guidance tailored to your specific situation and help you make the most of your finances.

Tips for Successful Budgeting

1. Automate Your Savings: Set up automatic transfers from your checking account to your savings or investment accounts to ensure consistent savings.

2. Use Cash Envelopes: Allocate a certain amount of cash for different categories and use envelopes to separate and control your spending.

3. Cut Unnecessary Expenses: Review your expenses regularly and identify areas where you can cut back, such as subscriptions or dining out.

4. Take Advantage of Technology: Use budgeting apps or online tools to track your expenses, set financial goals, and monitor your progress.

5. Involve Your Family: If you have a family, involve them in the budgeting process and discuss financial goals together.

6. Plan for Irregular Expenses: Anticipate irregular expenses like car repairs or medical bills and set aside money each month to cover them.

Conclusion

A home budget is a powerful tool that can transform your financial life. By creating a budget, tracking your expenses, and setting financial goals, you can take control of your finances and achieve long-term financial stability. Remember to review and adjust your budget regularly to stay on track and make the most of your money. Start budgeting today and enjoy the benefits of financial freedom!

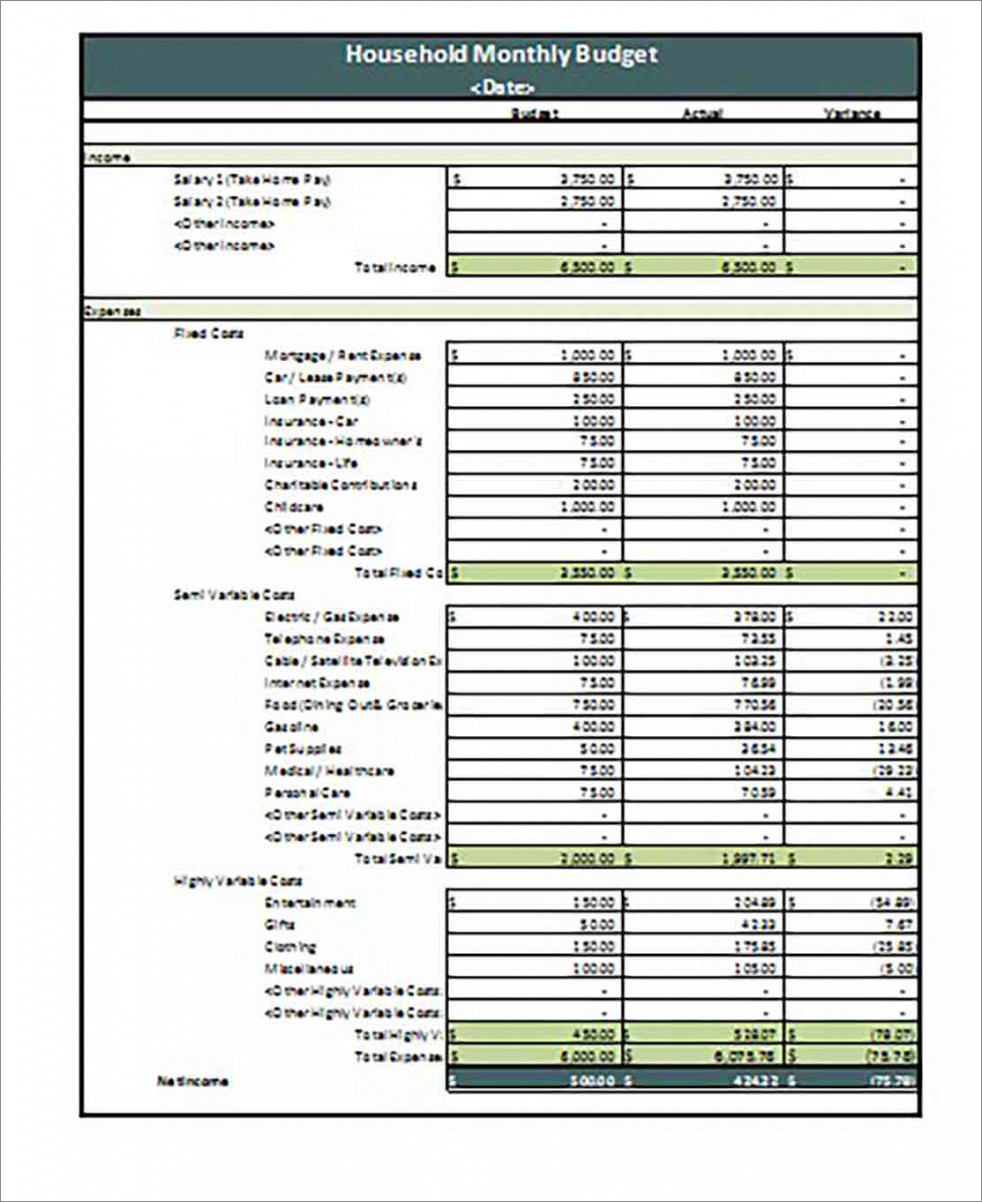

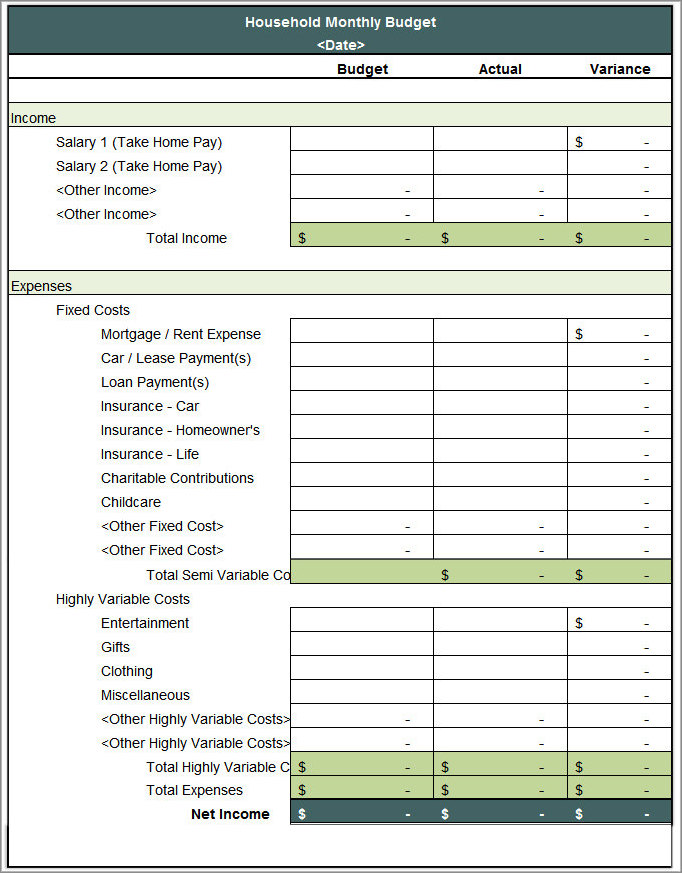

Home Budget Template Excel – Download