What is a gift of equity letter?

A gift of equity letter is a written document that outlines the transfer of ownership of a property from one party to another at a value lower than the current market price. This letter serves as proof of the gift and is usually required by mortgage lenders when the buyer is using the gift of equity as part of their down payment. The purpose of a gift of equity letter is to establish the legal transfer of the property and ensure that all parties involved understand the terms and conditions of the gift.

One of the main benefits of a gift of equity letter is that it allows a buyer to purchase a property with a lower down payment. This can be particularly helpful for first-time homebuyers or those who may not have enough savings for a substantial down payment. By receiving a gift of equity, the buyer can reduce their financial burden and increase their chances of qualifying for a mortgage.

Another benefit of a gift of equity letter is that it can help families transfer property within the family without the need for a traditional sale. This can be beneficial for parents who want to help their children become homeowners or for individuals who want to keep a property within the family. The gift of equity letter ensures that the transfer is legally binding and provides clarity on the terms of the gift.

What happens if you receive a gift of equity from a family member?

When you receive a gift of equity from a family member, it can be a significant boost towards becoming a homeowner. A gift of equity is when a family member sells their property to you at a price lower than its current market value. This generous act can help you secure a mortgage loan with a lower down payment and potentially lower interest rates.

However, it’s important to note that there are certain tax implications and legal considerations involved in such transactions. Consulting with a real estate attorney or tax professional is recommended to ensure compliance with the law and to navigate the process smoothly. With careful planning and expert guidance, you could be well on your way to homeownership.

What steps need to be completed for a gift of equity?

When completing a gift of equity, several important steps need to be followed to ensure a smooth and legal transaction. These steps include:

- Obtaining an appraisal: The first step in the gift of equity process is to obtain an appraisal of the property. This appraisal will determine the current market value of the property and will be used to calculate the gift amount.

- Agreeing on the gift amount: Once the appraisal is complete, both the donor and the recipient of the gift need to agree on the amount of equity that will be transferred. This amount is typically based on the appraised value of the property.

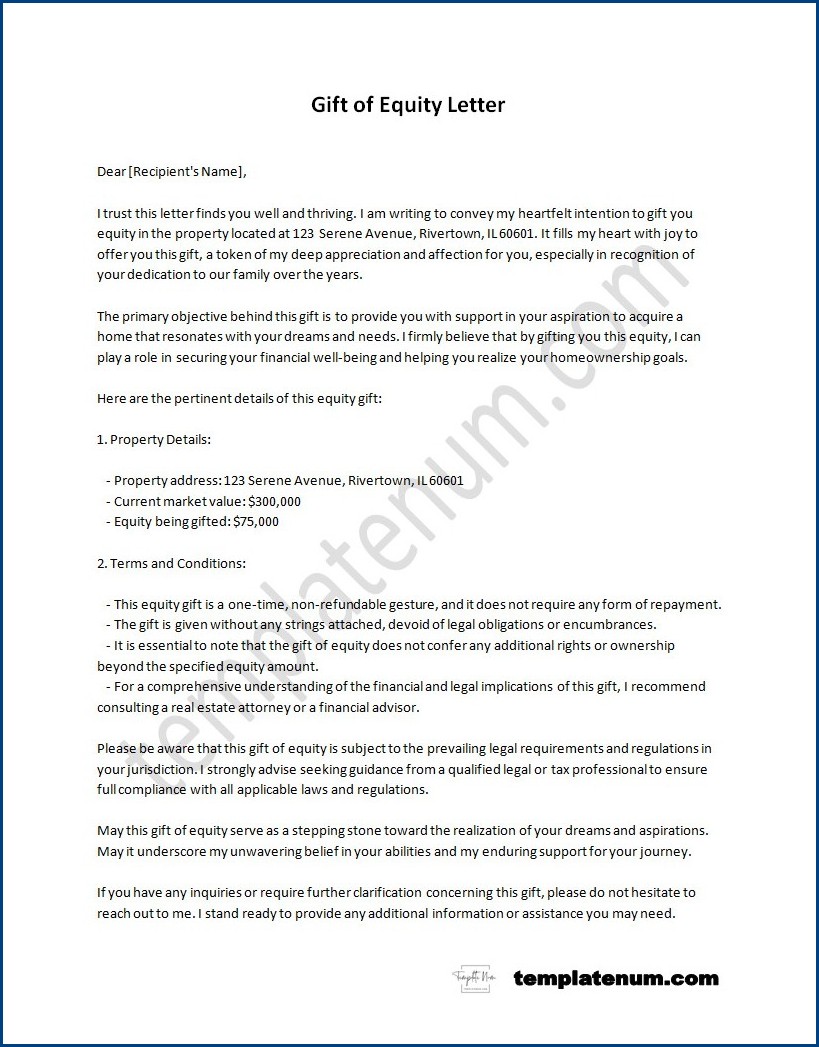

- Preparing the necessary paperwork: To make the gift of equity official, legal paperwork needs to be ready. This paperwork typically includes a gift letter, which outlines the details of the gift and states that it is being given without any expectation of repayment.

- Consulting with professionals: It is highly recommended to consult with professionals such as real estate attorneys, accountants, and mortgage brokers to ensure that all legal and financial aspects of the gift of equity are handled properly.

- Completing the transfer: Once all the necessary paperwork has been prepared and reviewed, the transfer of equity can take place. This typically involves filing the appropriate documents with the relevant authorities and updating the property’s title.

- Informing lenders and insurers: If there is an existing mortgage on the property, it is important to inform the lender about the gift of equity. Additionally, homeowners insurance may need to be updated to reflect the change in ownership.

What kind of mortgage can a buyer take out with a gift of equity?

When a buyer receives a gift of equity, which is a portion of the home’s value given to them as a gift by the seller, they have several options for the type of mortgage they can take out. One option is a conventional mortgage, which is a loan that is not guaranteed or insured by the government. With a gift of equity, the buyer can use the equity as a down payment, reducing the amount they need to borrow and potentially eliminating the need for private mortgage insurance (PMI). This can result in lower monthly mortgage payments and potentially save the buyer thousands of dollars over the life of the loan. Additionally, the buyer may be able to secure a lower interest rate with a conventional mortgage compared to other loan options.

Another mortgage option for a buyer with a gift of equity is an FHA loan. An FHA loan is insured by the Federal Housing Administration and is often a popular choice for first-time homebuyers or buyers with lower credit scores. With a gift of equity, the buyer can use the equity as a down payment, which can help them meet the minimum down payment requirement of 3.5% of the purchase price. The gift of equity can also be used to cover closing costs or other expenses associated with purchasing the home. FHA loans typically have more lenient credit and income requirements than conventional ones, making them accessible to a wider range of buyers.

How do you write a gift of equity contract?

When writing a gift of equity contract, it is important to include all the necessary details and ensure that both parties understand and agree to the terms. Here are some steps to help you write a gift of equity contract:

- Identify the parties: Begin the contract by clearly identifying the parties involved, including the donor (the person giving the gift) and the recipient (the person receiving the gift).

- Describe the property: Provide a detailed description of the property being gifted, including the address, legal description, and any other relevant information.

- State the gift amount: Clearly state the amount of the gift of equity, which is the difference between the fair market value of the property and the outstanding mortgage balance.

- Specify any conditions: If there are any conditions or restrictions attached to the gift, such as limitations on how the property can be used or sold, make sure to include them in the contract.

- Include signatures and dates: Both parties should sign and date the contract to indicate their agreement and acknowledgment of the terms.

- Consult a lawyer: It is recommended to consult with a real estate lawyer to ensure that the gift of equity contract is legally binding and covers all necessary aspects.

Writing a gift of equity contract requires careful attention to detail and thorough documentation. It is essential to have a clear understanding of the terms and for both parties involved to agree to the contract before proceeding with the gift transaction. By following these steps and seeking legal advice if needed, you can create a comprehensive and legally binding gift of equity contract.