A company’s monthly budget refers to the financial plan that an organization creates to track and manage its expenses and revenues every month. It serves as a roadmap for the company’s financial activities, allowing managers to allocate resources efficiently, make informed decisions, and ensure financial stability. A well-planned and executed budget provides valuable insights into the company’s financial health, helps identify areas for improvement, and enables the achievement of financial goals.

Why Does a Company Need a Monthly Budget?

Having a monthly budget is crucial for the success of any company, regardless of its size or industry. Here are some reasons why:

- Financial Planning: A monthly budget allows companies to plan and forecast their financial activities, ensuring that they have enough resources to cover expenses and meet financial obligations.

- Expense Management: With a budget in place, companies can monitor and control their expenses effectively, reducing unnecessary spending and maximizing profitability.

- Resource Allocation: A budget helps companies allocate their resources efficiently, ensuring that each department or project receives the necessary funding to operate effectively.

- Goal Setting: By setting financial goals and tracking progress through a budget, companies can work towards achieving their objectives and measure their success along the way.

- Decision Making: A budget provides valuable insights that can support decision-making processes. It helps identify areas of improvement, prioritize investments, and evaluate the financial impact of different options.

- Financial Stability: A well-managed budget contributes to the financial stability of a company. It allows businesses to build reserves, manage cash flow effectively, and withstand unexpected financial challenges.

How to Create a Company Monthly Budget?

Creating a company monthly budget requires careful planning and attention to detail. Here is a step-by-step guide on how to create an effective budget:

1. Identify Income Sources

The first step is to identify all the sources of income for the company. This includes revenue from sales, investments, loans, or any other sources of incoming cash flow. It is important to have a clear understanding of the total amount of money available to the company.

2. Track Expenses

Next, it is essential to track and categorize all the expenses incurred by the company. This includes fixed costs such as rent, utilities, and salaries, as well as variable costs like marketing expenses, raw materials, and supplies. It is important to be thorough and include all relevant expenses to ensure an accurate budget.

3. Set Financial Goals

Based on the company’s objectives, set specific and realistic financial goals for the month. These goals can include targets for revenue, profit margin, cost reduction, or any other financial metrics that align with the company’s overall strategy.

4. Allocate Resources

Once the income and expenses are identified, allocate resources to different departments or projects based on their needs and importance. Prioritize essential expenses and allocate funds accordingly to ensure smooth operations.

5. Monitor and Adjust

A company monthly budget is not a one-time exercise. It requires constant monitoring and adjustment as circumstances change. Regularly review the budget, compare actual expenses with the projected budget, and make necessary adjustments to stay on track.

Benefits of Having a Company Monthly Budget

A well-executed company monthly budget offers numerous benefits that contribute to the overall success of the organization:

- Improved Financial Control: A budget provides a clear picture of the company’s financial performance and enables better control over expenses.

- Enhanced Decision Making: With accurate financial data and insights, managers can make informed decisions that align with the company’s goals and objectives.

- Increased Efficiency: By identifying areas of waste or inefficiency, a budget helps companies streamline operations and optimize resource allocation.

- Effective Communication: A budget serves as a communication tool, allowing stakeholders to understand the financial position and direction of the company.

- Financial Stability: With a budget in place, companies can plan for the future, build reserves, and mitigate financial risks, ensuring long-term stability.

Best Practices for Managing a Company Monthly Budget

To maximize the benefits of a company’s monthly budget, consider implementing the following best practices:

- Regular Review: Review the budget regularly to ensure that it remains accurate and relevant. Update it as necessary to reflect changing circumstances or business conditions.

- Involve Key Stakeholders: Involve relevant stakeholders, such as department heads or project managers, in the budgeting process to gather input and ensure buy-in.

- Track and Analyze Variances: Monitor and analyze the differences between the planned budget and the actual expenses. This will help identify trends, areas of concern, and opportunities for improvement.

- Consider Flexibility: While it’s important to stick to the budget, allow for some flexibility to accommodate unexpected expenses or opportunities that may arise.

- Use Budgeting Software: Consider using budgeting software or tools that can automate the process, streamline data collection, and provide real-time insights.

Conclusion

A company monthly budget is a valuable tool that helps organizations manage their finances effectively, make informed decisions, and achieve their financial goals. By creating a well-planned budget, tracking expenses, and regularly reviewing performance, companies can improve financial control, enhance efficiency, and ensure long-term stability. Implementing best practices and involving key stakeholders in the budgeting process can further enhance the effectiveness of the budget. Make budgeting a priority for your company and reap the benefits of financial success and stability.

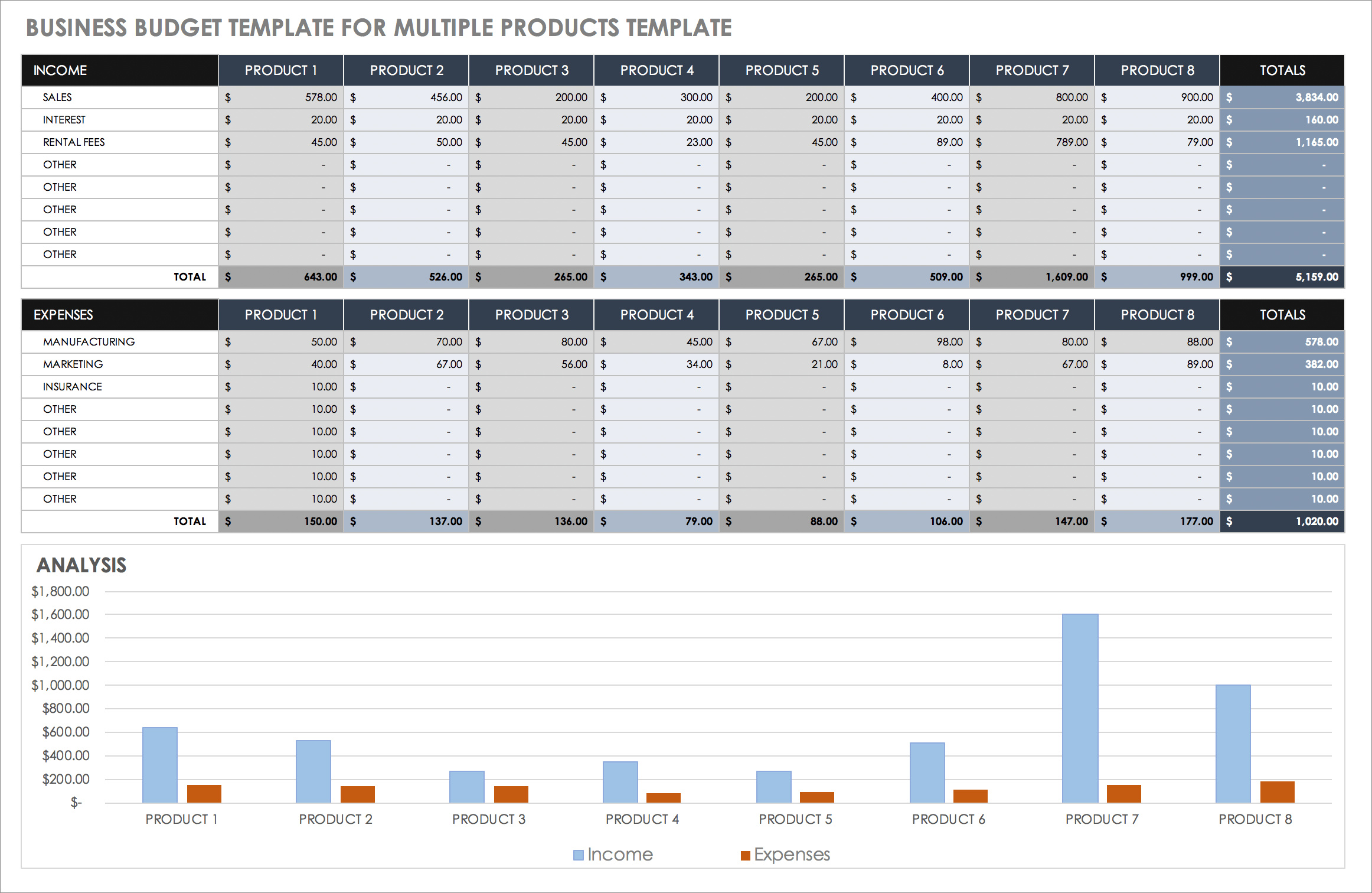

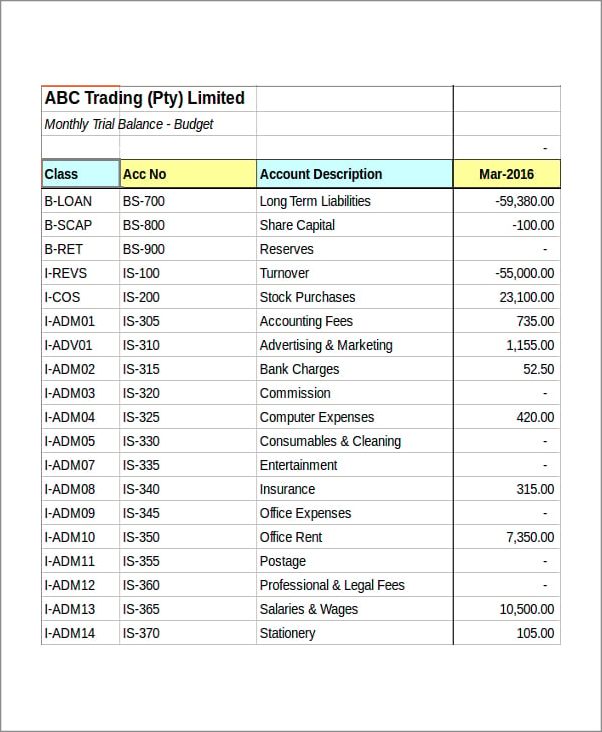

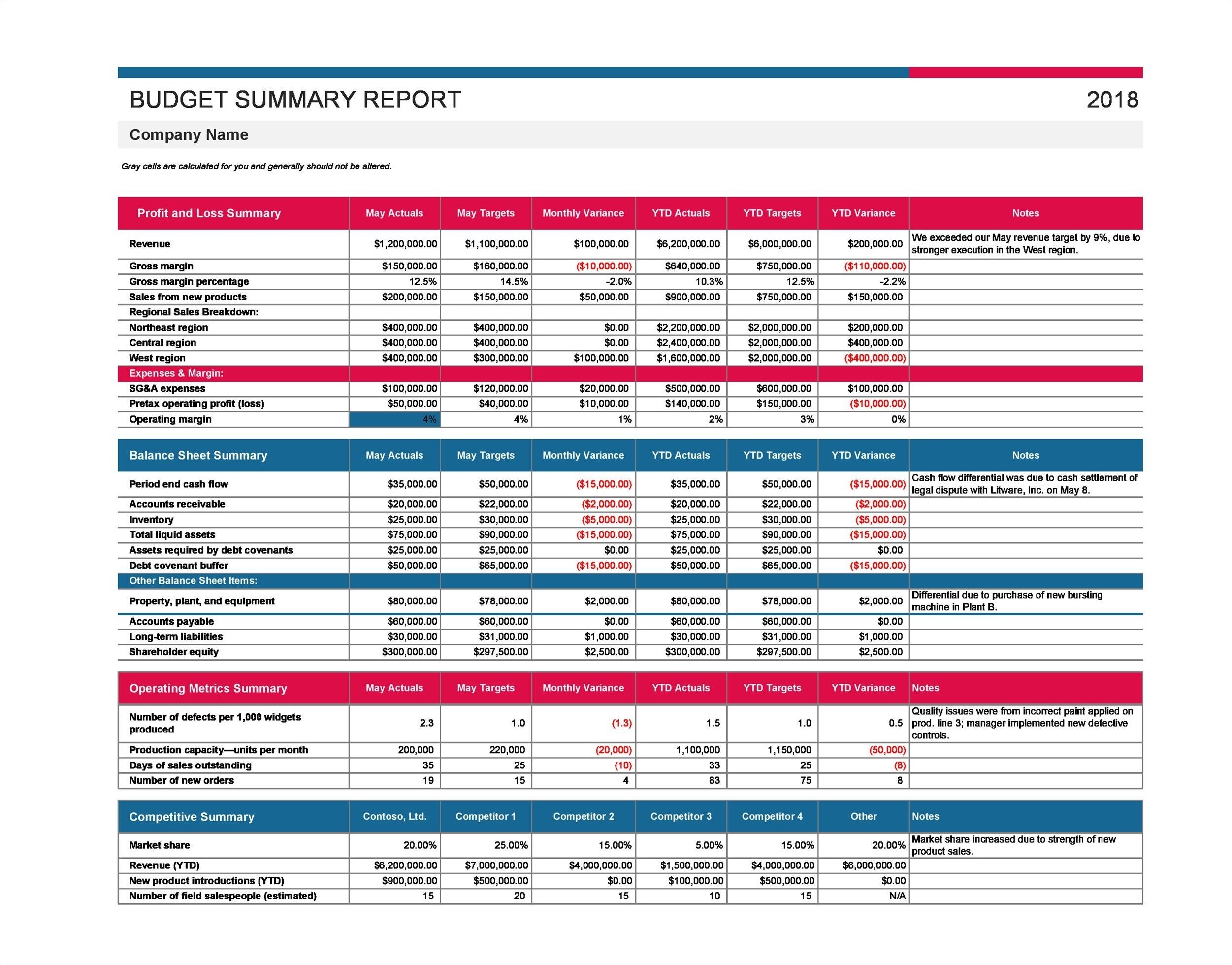

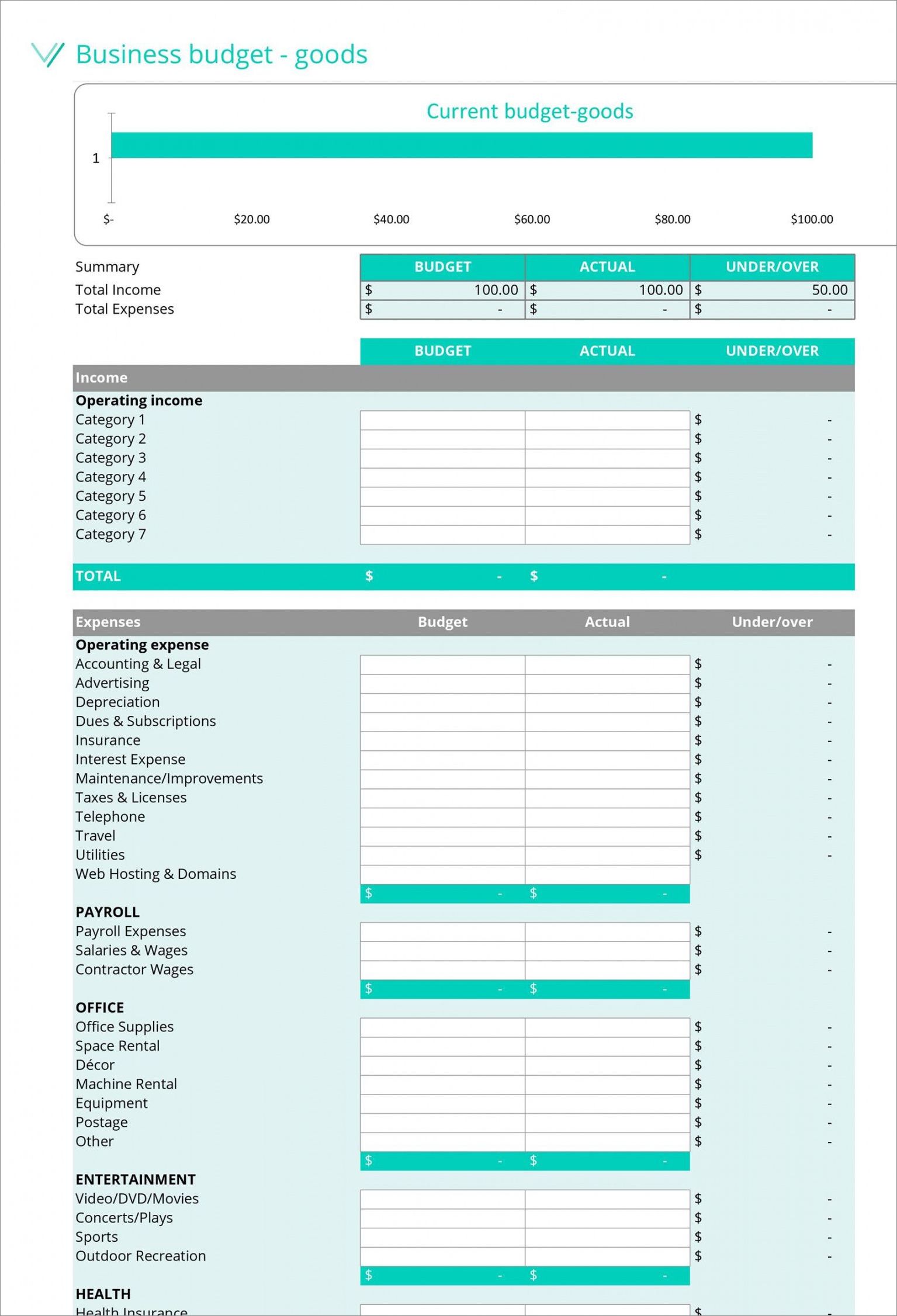

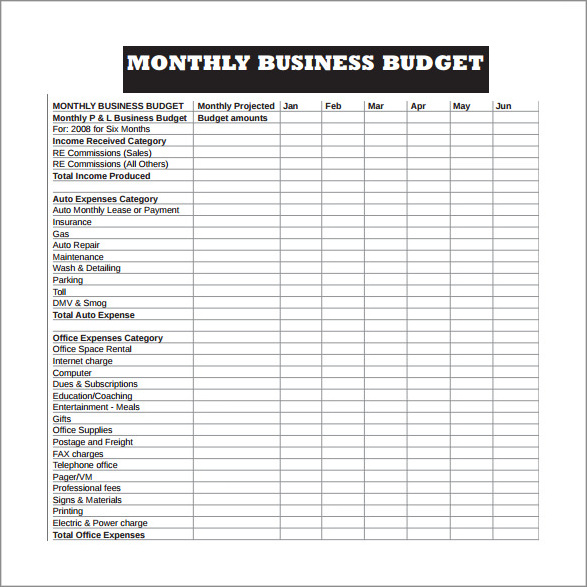

Company Monthly Budget Template Excel – Download