Mortgage invoices play a crucial role in the world of real estate and finance. They are essential documents that outline the details of a mortgage loan, including the amount borrowed, interest rate, payment schedule, and other important terms and conditions. Understanding mortgage invoices is important for both borrowers and lenders to ensure transparency and accuracy in financial transactions.

What is a Mortgage Invoice?

A mortgage invoice is a document that provides a detailed breakdown of a mortgage loan. It includes information such as the principal amount borrowed, the interest rate, the length of the loan term, and the monthly payment amount. Mortgage invoices are typically sent out by lenders to borrowers on a monthly basis, outlining the amount due and the due date for each payment.

The Purpose of Mortgage Invoices

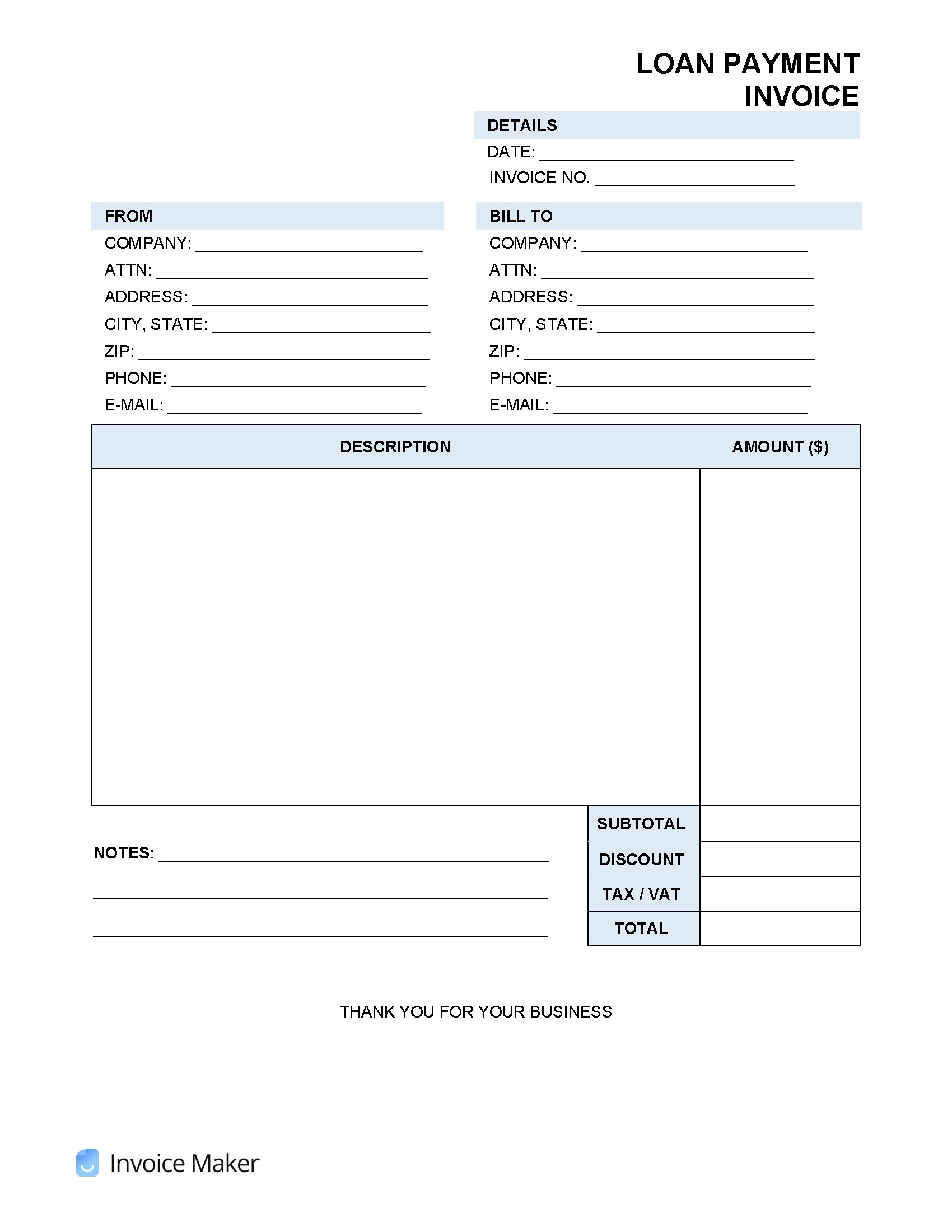

Image Source: invoicemaker.com

The primary purpose of a mortgage invoice is to provide borrowers with a clear and detailed overview of their loan obligations. By receiving a mortgage invoice each month, borrowers can keep track of their remaining balance, monitor their payment history, and ensure that they are meeting their financial obligations. For lenders, mortgage invoices serve as a record of the loan agreement and help ensure that payments are made on time.

Why Mortgage Invoices are Important

Mortgage invoices are important for both borrowers and lenders for several reasons. For borrowers, mortgage invoices provide a clear breakdown of their loan terms and help them stay organized with their finances. They also serve as a reminder of upcoming payments and help prevent any confusion or misunderstandings about the loan terms.

Image Source: spservicing.com

For lenders, mortgage invoices are important for tracking payments, monitoring the status of loans, and ensuring that borrowers are meeting their financial obligations. Mortgage invoices also serve as a legal document that outlines the terms and conditions of the loan agreement, providing a record of the financial transaction between the lender and the borrower.

How to Understand a Mortgage Invoice

Understanding a mortgage invoice can be overwhelming, especially for first-time homebuyers or those new to the world of finance. However, breaking down the information on a mortgage invoice into smaller, more manageable sections can help make it easier to understand. Here are some tips for successfully deciphering a mortgage invoice:

1. Review the Payment Breakdown

Image Source: googleapis.com

When you receive a mortgage invoice, the first thing you should do is review the payment breakdown. This section will outline the total amount due, the principal and interest portions of the payment, any escrow amounts for taxes and insurance, and any additional fees or charges.

2. Check the Payment Due Date

It is important to check the payment due date on your mortgage invoice to ensure that you make your payment on time. Late payments can result in fees, penalties, and even damage to your credit score. Make sure to mark your calendar with the due date to avoid missing a payment.

3. Understand the Interest Rate

Image Source: shutterstock.com

The interest rate on your mortgage invoice is a crucial component of your loan. It determines the amount of interest you will pay over the life of the loan and can significantly impact your monthly payment amount. Take the time to understand how the interest rate is calculated and how it affects your overall loan balance.

4. Review the Loan Balance

The loan balance section of your mortgage invoice will show you how much you still owe on your loan. It is important to monitor your loan balance each month to track your progress in paying down the loan and to identify any discrepancies or errors in the balance.

5. Check for Escrow Payments

Image Source: airslate.com

Many mortgage invoices include an escrow section that outlines any amounts collected for property taxes, homeowners insurance, or other expenses. Make sure to review this section carefully to ensure that your escrow payments are accurate and up-to-date.

6. Contact Your Lender with Questions

If you have any questions or concerns about your mortgage invoice, don’t hesitate to contact your lender for clarification. Lenders are typically willing to explain any confusing terms or numbers on your invoice and can help you understand your loan terms better.

7. Keep Records of Your Invoices

Image Source: amazonaws.com

It is essential to keep records of all your mortgage invoices for your own records and for tax purposes. Save electronic or hard copies of each invoice and keep them in a safe place where you can easily access them when needed. Keeping organized records can help you stay on top of your loan obligations and financial responsibilities.

8. Monitor Your Payment History

Lastly, be sure to monitor your payment history on your mortgage invoices. Tracking your payments each month can help you identify any missed or late payments and address any issues before they escalate. Monitoring your payment history can also help you stay on track with your financial goals and budgeting.

Tips for Successful Mortgage Invoicing

Image Source: exactdn.com

When it comes to managing your mortgage invoices effectively, there are several tips you can follow to ensure success. Here are some tips for successful mortgage invoicing:

Set Up Automatic Payments. Consider setting up automatic payments for your mortgage to ensure that you never miss a payment and avoid late fees.

Double-Check Your Invoices. Always double-check your mortgage invoices for accuracy and report any discrepancies to your lender immediately.

Create a Budget. Develop a budget that includes your monthly mortgage payment to help you manage your finances effectively.

Stay Organized. Keep all your mortgage invoices and financial records organized in a dedicated folder or digital file for easy access.

Plan for Unexpected Expenses. Be prepared for unexpected expenses by setting aside funds in case of emergencies or financial hardships.

Communicate with Your Lender. Maintain open communication with your lender to address any concerns or financial difficulties promptly.

Image Source: fnbo.com

In Conclusion

In conclusion, understanding and managing your mortgage invoices is essential for successful homeownership and financial stability. By familiarizing yourself with the details of your mortgage invoice, staying organized, and communicating effectively with your lender, you can navigate the complexities of mortgage invoicing with confidence. Remember to review your invoices carefully, ask questions when needed, and take proactive steps to ensure that your mortgage payments are made on time and accurately. By following these tips and best practices, you can streamline your mortgage invoicing process and achieve your financial goals with ease.

Image Source: pdffiller.com

Image Source: bankrate.com