A savings planner is a valuable tool that can help you track your income, expenses, and savings goals. Whether you are saving for a vacation, a new home, or retirement, having a savings planner can keep you organized and on track to meet your financial goals. In this article, we will explore the purpose of a savings planner, why it is important, how to create one, and tips for successful saving.

What is a Savings Planner?

A savings planner is a tool that helps individuals or families keep track of their income, expenses, and savings goals. It can be a physical planner, a spreadsheet, or a digital app that allows you to input your financial information and monitor your progress towards your savings goals. A savings planner typically includes sections for tracking income, expenses, savings contributions, and goal progress.

The Purpose of a Savings Planner

Image Source: vecteezy.com

The main purpose of a savings planner is to help you achieve your financial goals. By tracking your income and expenses, you can identify areas where you can cut back on spending and increase your savings. A savings planner can also help you stay motivated and accountable by visually seeing your progress towards your goals. Additionally, a savings planner can help you create a budget, prioritize your spending, and make informed financial decisions.

Why Use a Savings Planner?

Using a savings planner can provide numerous benefits for your financial well-being. By having a clear picture of your finances, you can identify patterns in your spending behavior and make necessary adjustments to meet your savings goals. A savings planner can also help you plan for unexpected expenses, save for emergencies, and build a financial cushion for the future. Overall, a savings planner can give you peace of mind knowing that you are in control of your finances and working towards a secure financial future.

How to Create a Savings Planner

Image Source: organizationobsessed.com

Creating a savings planner is simple and can be customized to fit your individual needs and preferences. Here are some steps to help you create a savings planner:

1. Determine Your Savings Goals

Before creating a savings planner, it is important to identify your short-term and long-term savings goals. Whether you are saving for a specific purchase, an emergency fund, or retirement, having clear goals will help you stay focused and motivated.

2. Track Your Income and Expenses

Image Source: raketcontent.com

To create a savings planner, start by tracking your income and expenses for a month. This will give you a clear understanding of where your money is going and how much you can realistically save each month.

3. Set a Budget

Based on your income and expenses, create a monthly budget that includes savings contributions. Allocate a portion of your income towards savings goals, and prioritize essential expenses such as housing, utilities, and groceries.

4. Monitor Your Progress

Image Source: moderntype.com

Regularly update your savings planner to track your progress towards your savings goals. Review your budget, adjust your spending habits if necessary, and celebrate milestones along the way to stay motivated.

5. Adjust as Needed

As your financial situation changes, be flexible and adjust your savings planner accordingly. If unexpected expenses arise, reevaluate your budget and savings goals to stay on track towards financial success.

Tips for Successful Saving

Image Source: pinimg.com

To maximize the effectiveness of your savings planner and achieve your financial goals, consider the following tips:

Automate Your Savings. Set up automatic transfers from your checking account to your savings account to ensure consistent contributions.

Cut Back on Unnecessary Expenses. Identify areas where you can reduce spending and redirect those funds towards savings.

Track Your Progress. Regularly review your savings planner and adjust your budget as needed to stay on track towards your goals.

Stay Motivated. Set small milestones and reward yourself for reaching them to maintain momentum and enthusiasm for saving.

Seek Professional Advice. Consider consulting a financial advisor for personalized guidance on saving strategies and investment options.

Review and Reflect. Periodically review your savings planner, reflect on your financial progress, and make adjustments to optimize your savings strategy.

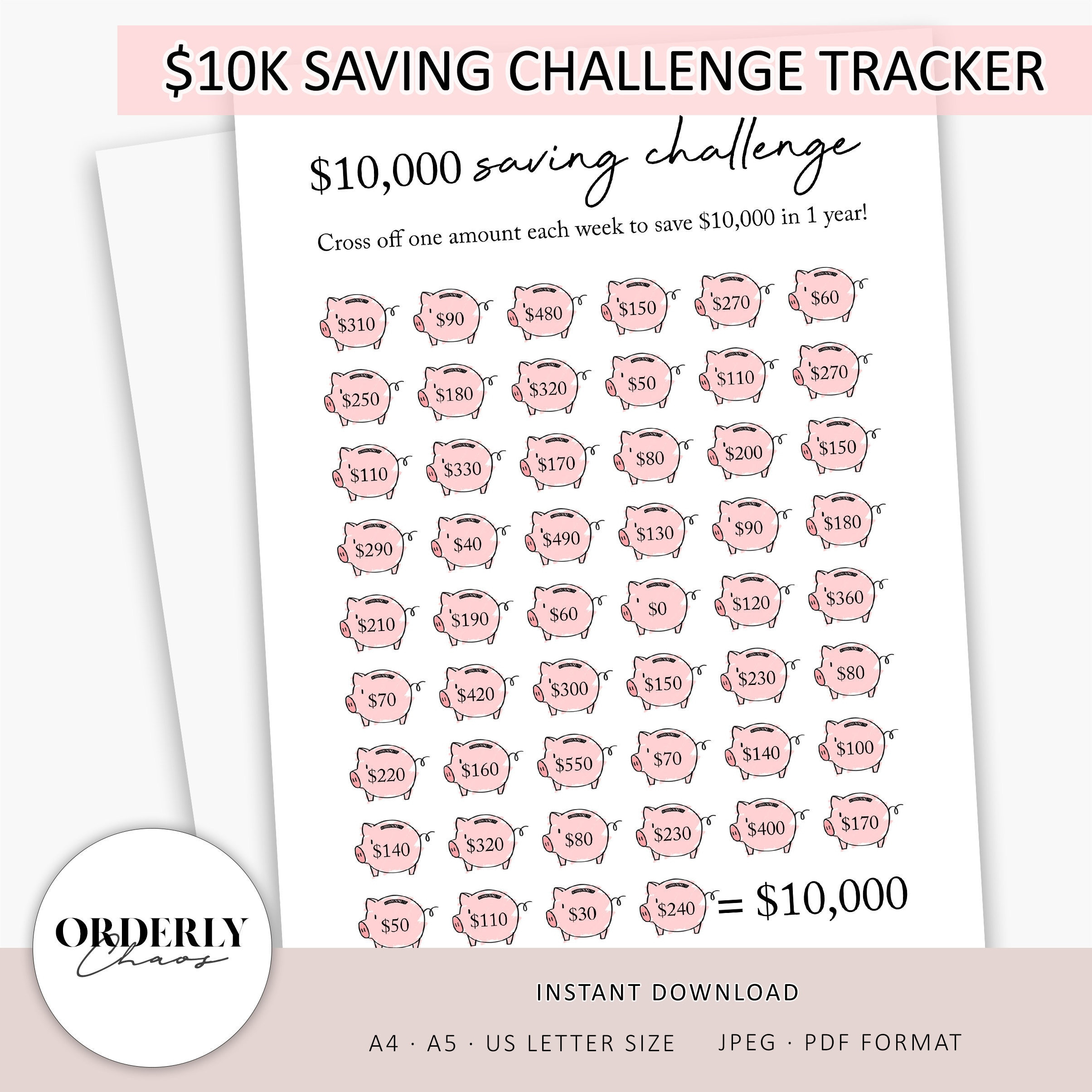

Image Source: etsystatic.com

In Conclusion

A savings planner is a valuable tool that can help you take control of your finances, achieve your savings goals, and build a secure financial future. By creating a savings planner, setting clear goals, following a budget, and staying disciplined, you can make significant progress towards financial success. Use the tips provided in this article to enhance your savings planner and maximize your savings potential. Start today and watch your savings grow!

Image Source: ebonynotes.co

Image Source: etsystatic.com