Budget Planner: Taking Control of Your Finances

Budgeting is a crucial part of managing your finances effectively. It allows you to track your income and expenses, set financial goals, and make informed decisions about where your money goes. A budget planner is a tool that can help you streamline this process and take control of your financial future. Whether you are saving for a big purchase, paying off debt, or simply trying to make ends meet, a budget planner can help you achieve your financial goals.

What is a Budget Planner?

Image Source: squarespace-cdn.com

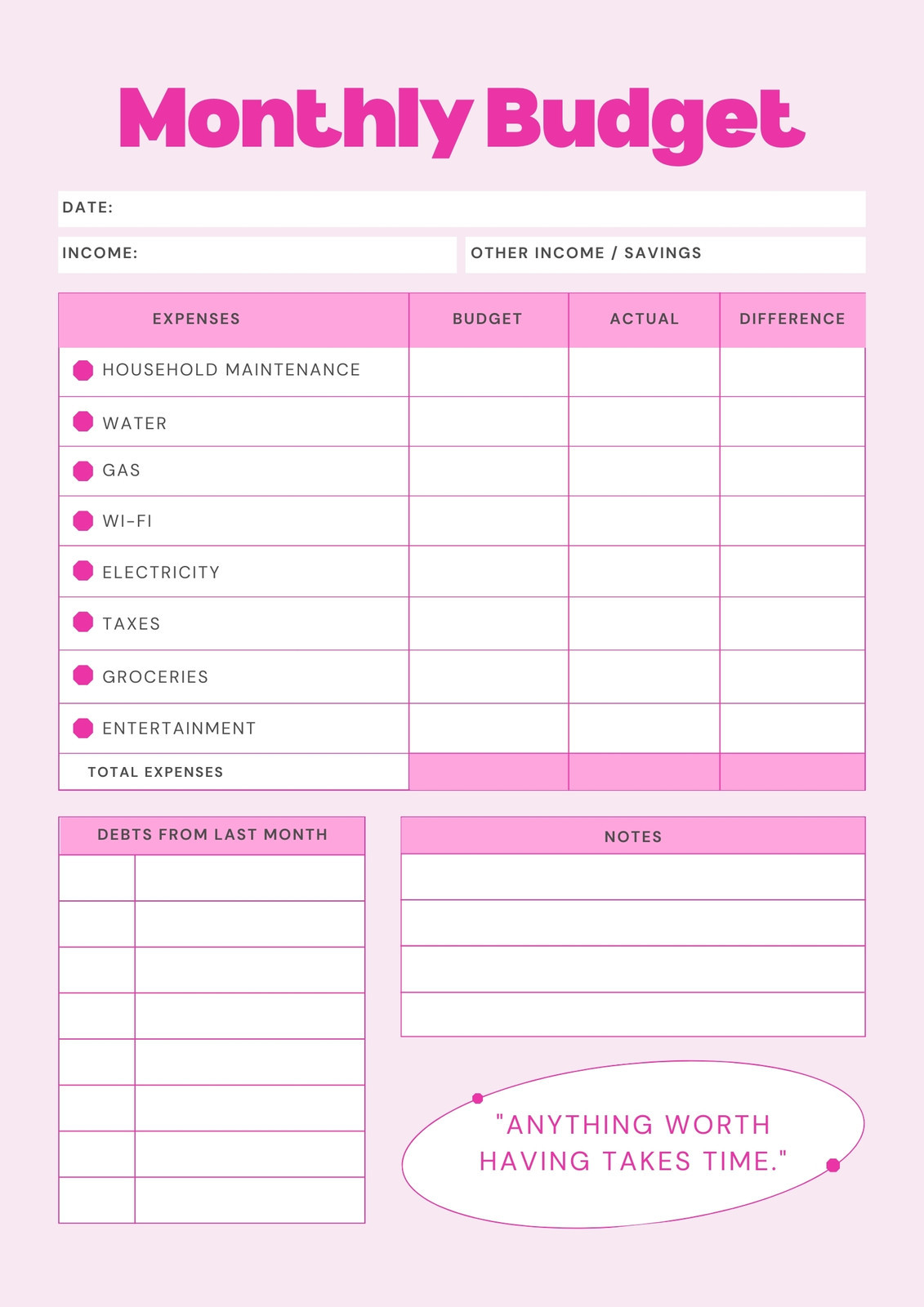

A budget planner is a tool that helps you track your income and expenses, set financial goals, and manage your money effectively. It allows you to create a detailed plan for how you will allocate your funds each month, taking into account your fixed expenses, variable expenses, savings goals, and any debt repayments you may have. By using a budget planner, you can gain a clear picture of your financial situation and make informed decisions about how to use your money wisely.

The Purpose of a Budget Planner

The main purpose of a budget planner is to help you take control of your finances and achieve your financial goals. By using a budget planner, you can:

Image Source: canva.com

– Track your income and expenses: A budget planner allows you to see exactly how much money you have coming in and going out each month.

– Set financial goals: Whether you want to save for a vacation, buy a new car, or pay off debt, a budget planner can help you set realistic financial goals and create a plan to achieve them.

– Make informed decisions: With a budget planner, you can make informed decisions about where to allocate your funds, whether it’s cutting back on unnecessary expenses, increasing your savings, or paying off debt.

– Avoid overspending: A budget planner can help you identify areas where you may be overspending and make adjustments to stay within your budget.

– Build a financial cushion: By setting aside money for emergencies and unexpected expenses, a budget planner can help you build a financial cushion and protect yourself from financial setbacks.

Why You Need a Budget Planner

Many people struggle with managing their finances effectively because they lack a clear plan for how to use their money. Without a budget planner, it’s easy to overspend, accumulate debt, and fall short of your financial goals. A budget planner provides a roadmap for your finances, helping you stay on track and make progress towards achieving your financial dreams.

How to Use a Budget Planner

Image Source: canva.com

Using a budget planner is simple yet powerful. Here are some steps to help you get started:

1. Gather your financial information: Start by collecting information on your income, expenses, savings goals, and debt repayments.

2. Set financial goals: Identify what you want to achieve with your money, whether it’s saving for a house, paying off student loans, or building an emergency fund.

3. Create a budget: Use your budget planner to allocate your income towards your expenses, savings goals, and debt repayments.

4. Track your spending: Monitor your expenses regularly to ensure you are staying within your budget and making progress towards your financial goals.

5. Make adjustments: If you find that you are overspending in certain areas, make adjustments to your budget to stay on track.

6. Review and revise: Regularly review your budget planner to track your progress and make any necessary revisions to your financial plan.

Tips for Successful Budgeting

Image Source: ivorypaperco.com

Successfully managing your finances with a budget planner requires commitment and discipline. Here are some tips to help you make the most of your budget planner:

Stay organized: Keep all your financial documents in one place and regularly update your budget planner with accurate information.

Be realistic: Set achievable financial goals and create a budget that reflects your income and expenses accurately.

Track your spending: Monitor your expenses regularly to ensure you are staying within your budget and making progress towards your financial goals.

Review your budget: Regularly review your budget planner to track your progress and make adjustments as needed.

Seek support: If you are struggling with budgeting, seek help from a financial advisor or a trusted friend or family member who can provide guidance and support.

Celebrate your successes: When you reach a financial milestone or achieve a financial goal, celebrate your success and use it as motivation to continue managing your finances effectively.

Image Source: etsystatic.com

In conclusion, a budget planner is a valuable tool that can help you take control of your finances, set financial goals, and make informed decisions about your money. By using a budget planner effectively, you can achieve your financial dreams and build a secure financial future for yourself and your family. With commitment, discipline, and the right mindset, you can successfully manage your finances and enjoy peace of mind knowing that you are in control of your financial destiny.

Image Source: canva.com

Image Source: etsystatic.com

Image Source: canva.com