A Good Faith Estimate (GFE) is a document that outlines the estimated costs associated with obtaining a mortgage loan. This document is provided by lenders to borrowers early in the loan application process to give them an idea of what to expect in terms of fees, closing costs, and other expenses. The purpose of a Good Faith Estimate is to help borrowers understand the costs involved in obtaining a mortgage loan and to compare offers from different lenders.

Why is a Good Faith Estimate important? It is crucial for borrowers to have a clear understanding of the costs associated with obtaining a mortgage loan. By providing an estimate of these costs upfront, lenders help borrowers make informed decisions about their loan options. Without a Good Faith Estimate, borrowers may be caught off guard by unexpected fees and expenses at the closing table.

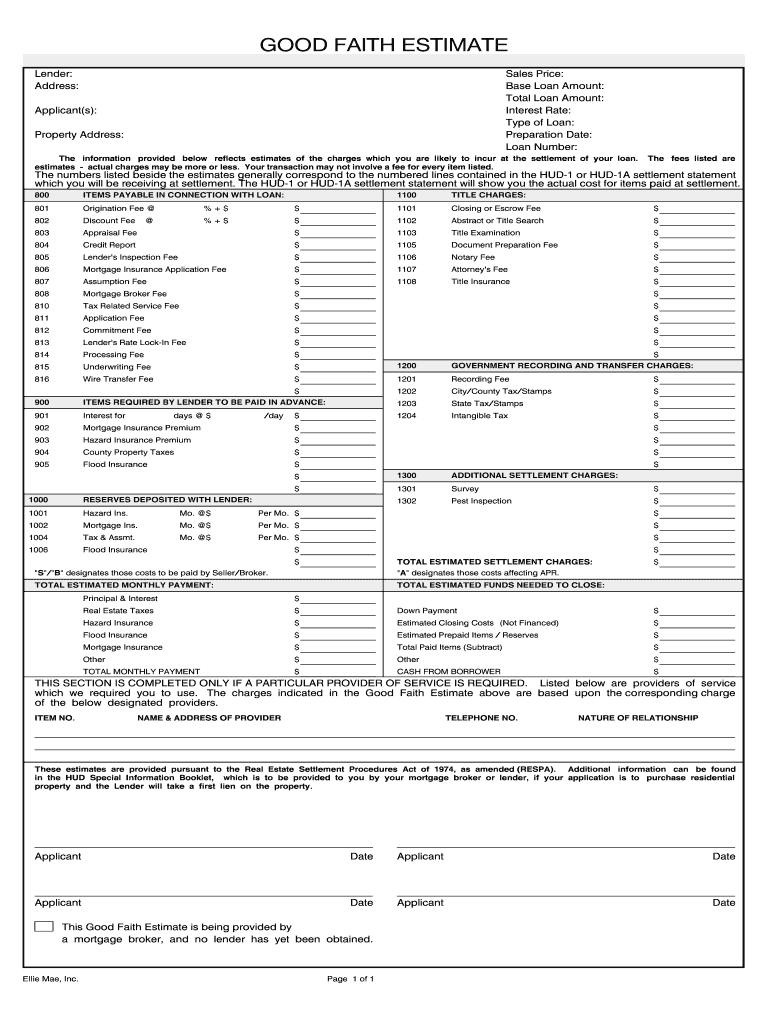

Image Source: i0.wp.com

How to interpret a Good Faith Estimate? When reviewing a Good Faith Estimate, borrowers should pay close attention to the various fees and costs listed. Some of the key items to look for include the interest rate, loan terms, closing costs, and any other fees associated with the loan. Borrowers should also compare the Good Faith Estimate from multiple lenders to ensure they are getting the best possible deal.

Tips for successful comparison of Good Faith Estimates:

1. Compare apples to apples: Make sure you are comparing similar loan products from different lenders. Look at the interest rate, loan term, and closing costs to get an accurate comparison.

2. Watch out for hidden fees: Some lenders may try to sneak in extra fees that are not listed on the Good Faith Estimate. Be sure to ask about any fees that are not clearly outlined on the document.

3. Negotiate with lenders: If you receive multiple Good Faith Estimates, don’t be afraid to negotiate with lenders to try and get a better deal. Lenders may be willing to lower fees or offer better terms to win your business.

4. Ask questions: If you are unsure about any of the fees or costs listed on the Good Faith Estimate, don’t hesitate to ask the lender for clarification. It is important to have a clear understanding of all the expenses involved in obtaining a mortgage loan.

5. Get everything in writing: Once you have reviewed the Good Faith Estimate and negotiated with lenders, be sure to get all the terms and conditions in writing. This will help protect you in case there are any discrepancies at the closing table.

6. Be prepared for changes: Keep in mind that the Good Faith Estimate is just an estimate of the costs involved in obtaining a mortgage loan. The actual costs may vary slightly at the time of closing, so it is important to be prepared for any potential changes.

7. Work with a reputable lender: When comparing Good Faith Estimates, be sure to choose a lender that has a good reputation and a track record of providing excellent customer service. A reputable lender will be transparent about the costs involved and will help guide you through the mortgage process.

8. Don’t rush the decision: Take your time to carefully review and compare Good Faith Estimates from different lenders. Rushing into a decision could result in higher costs or unfavorable loan terms. It is important to do your due diligence and make an informed decision that is in your best interest.

Image Source: northcountryhealth.org

In conclusion, a Good Faith Estimate is a valuable tool for borrowers to understand the costs associated with obtaining a mortgage loan. By carefully reviewing and comparing Good Faith Estimates from multiple lenders, borrowers can make informed decisions and ensure they are getting the best possible deal. By following the tips outlined above, borrowers can navigate the mortgage process with confidence and secure a loan that meets their needs.

Image Source: pdffiller.com

Image Source: belongly.com

Image Source: trainingleader.com

Image Source: pdffiller.com

Image Source: simplepractice.com

Image Source: i3solutions.com

Image Source: website-files.com