A family budget is a financial plan that helps you track and manage your income and expenses to ensure that you are meeting your financial goals. It allows you to allocate your resources wisely and make informed decisions about where your money should go. A well-planned family budget can help you save for the future, pay off debt, and achieve financial stability.

Why is a Family Budget Important?

A family budget is important for several reasons. First and foremost, it gives you a clear picture of your financial situation and helps you identify areas where you can save money. It allows you to prioritize your expenses and make conscious choices about how you spend your money. A family budget also helps you set financial goals and track your progress toward achieving them. By sticking to a budget, you can avoid unnecessary debt and build a strong financial foundation for your family.

How to Create a Family Budget

Creating a family budget may seem daunting, but it doesn’t have to be. Follow these steps to get started:

1. Determine Your Income

The first step in creating a family budget is to determine your total income. This includes all sources of income, such as salaries, bonuses, rental income, and any other money that comes into your household. Make sure to consider both regular and irregular income, and be realistic about what you can expect to earn.

2. Track Your Expenses

Next, track your expenses for at least a month to get a clear understanding of where your money is going. Keep track of everything you spend, from groceries and bills to entertainment and transportation. This will help you identify areas where you can cut back and save money.

3. Categorize Your Expenses

Once you have tracked your expenses, categorize them into different groups, such as housing, transportation, groceries, utilities, and entertainment. This will make it easier to see how much you are spending in each category and identify areas where you can make adjustments.

4. Set Financial Goals

Based on your income and expenses, set financial goals for your family. These goals could include saving for a down payment on a house, paying off debt, or building an emergency fund. Make sure your goals are specific, measurable, achievable, relevant, and time-bound (SMART goals).

5. Allocate Your Income

Now that you have a clear understanding of your income, expenses, and financial goals, it’s time to allocate your income accordingly. Start by covering your essential expenses, such as housing, utilities, food, and transportation. Then, allocate a portion of your income towards your financial goals and savings. Finally, set aside some money for discretionary expenses, such as entertainment and dining out.

6. Track Your Progress

Once you have created your family budget, it’s important to track your progress regularly. Review your budget every month and compare your actual expenses to your planned expenses. This will help you identify any areas where you may be overspending and make adjustments as needed.

7. Make Adjustments as Needed

A family budget is not set in stone and may need to be adjusted over time. Life circumstances change, and your financial goals may evolve. Be flexible and willing to make adjustments to your budget as needed to ensure it continues to align with your financial goals.

Tips for Managing Your Family Budget

- Create an emergency fund. It’s important to have a financial safety net for unexpected expenses. Aim to save at least three to six months’ worth of living expenses in an emergency fund.

- Automate your savings. Set up automatic transfers from your checking account to a savings account to make saving money effortless.

- Shop smart. Look for deals, use coupons, and compare prices before purchasing to save money on everyday expenses.

- Communicate with your family. Make sure everyone in your family is aware of the budget and understands the financial goals. Encourage open communication about money matters.

- Review your budget regularly. Life circumstances change, and your budget should reflect those changes. Review your budget regularly and make adjustments as needed.

- Pay off debt. Prioritize paying off high-interest debt to save money on interest payments and improve your financial well-being.

Conclusion

Managing a family budget may seem challenging, but with careful planning and discipline, it can be a rewarding experience. By creating a family budget, you can gain control over your finances, achieve your financial goals, and provide a secure future for your family. Remember to track your income and expenses, set realistic goals, and make adjustments as needed. With a well-managed family budget, you can enjoy financial stability and peace of mind.

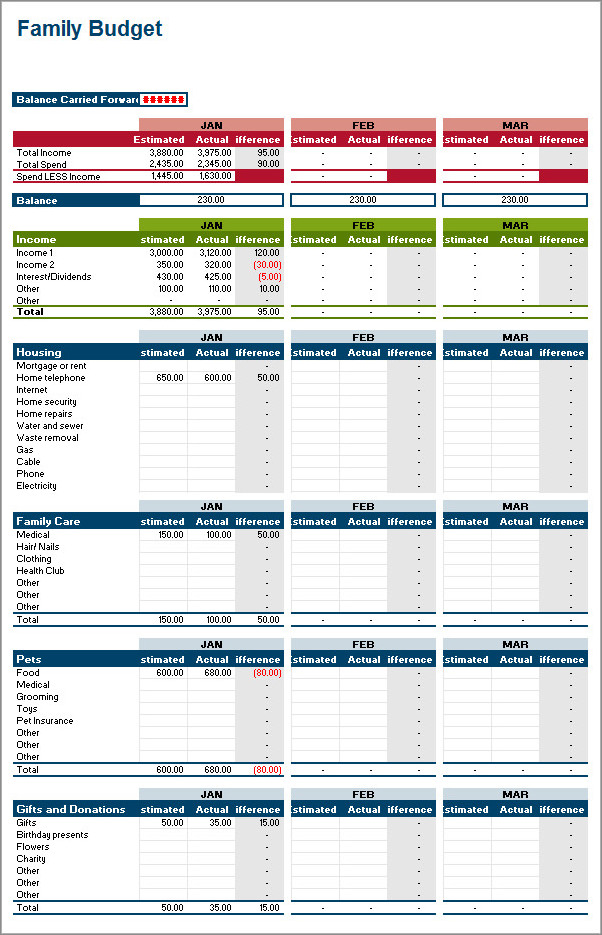

Family Budget Template Excel – Download